Quick Takes

- Strong Stock Markets. Equity markets rallied in November after Donald Trump won re-election. The S&P 500 was up 5% during the month. This was also helped by strong results from companies like Amazon, Walmart, and Nvidia.

- Inflation and Interest Rates. The 10Y treasury yield fell slightly in November from 4.4% to 4.2%. Unemployment remained steady at 4.1% and nonfarm payrolls increased by just 12K because of strikes and hurricanes. CPI inflation rose to 2.6% in October from 2.4% in September. PCE inflation came in at 2.8% in line with forecasts.

- Antitrust. The Department of Justice requested Google to sell its Chrome browser on antitrust grounds in November as well as its android business. In the meantime, the Federal Trade Commission moved to prevent UnitedHealth’s purchase of Amedisys.

- Trump Tariff Threats. President-Elect Donald Trump has announced that he would enact tariffs on imported goods to help American industry. He announced that he would enact a 25% tariff on all imports from Canada and Mexico. He also wants to tax Chinese imports at an additional 10%.

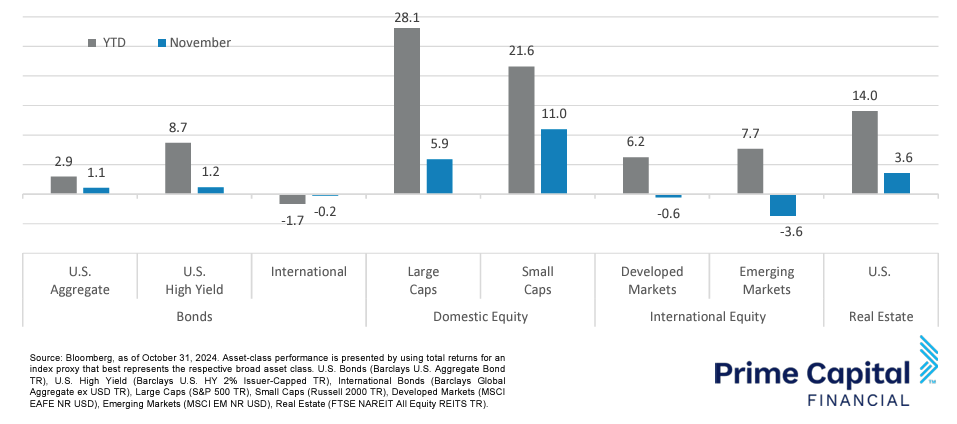

Asset Class Performance

Small Caps had a good November, beating large caps following a Trump election victory. International stocks lagged the U.S. market during the month amid Trump’s tariff threats and conflict in the Middle East. Domestic assets across the board ended the month higher including both fixed-income and equities while international assets generally fell.

Markets & Macroeconomics

The economy continued to show signs of strength in November, although manufacturing activity remained weak based on new data from October. Nonfarm payroll growth for October was weaker than expected at 12k versus the expected 100k additions because of the strikes and hurricanes that hit Florida, Georgia, and the Carolinas. Unemployment remains low, but higher than it was at the beginning of the year at 4.1%. Forecasts indicate an expected addition of 215k jobs in November while unemployment is expected to have remained constant at 4.1%. Despite generally strong employment data and consistent unemployment, manufacturing employment growth has been very weak this year.

October saw a larger decline than expected in manufacturing payrolls with a decline of 46k versus the forecasted loss of 30k. Before October’s print, total US manufacturing payrolls had already fallen by 41k this year. The economy is forecasted to have added 30k manufacturing jobs in November, but even if that number is correct, total manufacturing employment will still have fallen by 57k jobs in 2024. Meanwhile, inflation accelerated slightly in October with the PCE Price Index increasing 2.3% YoY in October versus the prior month’s YoY increase of 2.1%. CPI inflation in October was 2.6% versus September’s YoY increase of 2.4%.

Despite this acceleration in the headline numbers, core inflation remained more in line with the prior month’s measures with Core PCE increasing 2.8% YoY in October versus September’s 2.7% increase and Core CPI increasing YoY by 3.3% in October versus a 3.3% increase in September. The FOMC cut interest rates in November by 25 bps with the Federal Funds target rate now at 4.50-4.75%. Fed Minutes from November 6-7 indicate that the FOMC will look to continue interest rate cuts if inflation continues to move toward the Fed’s long-term target of 2%, although some FOMC members are concerned about inflation remaining elevated relative to this target despite progress. The FOMC also indicated that upside risk to inflation going forward has not changed significantly since the committee’s last meeting while downside risks to growth and employment seem to have eased. Investors are currently pricing in another 25-bp cut to rates at the Fed’s December 18 meeting.

Bottom Line: Inflation remains elevated but is not straying too far from expectations. Unemployment remains low at 4.1%, but manufacturing jobs growth has been weak this year. The FOMC cut rates in November to reduce potential pressure on economic growth and employment. While investors expect another cut in December, the FOMC says that more cuts will depend on inflation falling to 2%.