Quick Takes

- Stocks Higher. U.S. equity indices were higher in May as temporary breaks on tariffs and relatively strong earnings boosted sentiment. The S&P 500 jumped 6.1% and the Nasdaq 100 rose 9.0%. The Magnificent 7 rose about 13.3% in May as big technology companies reported quarterly results.

- Inflation and Interest Rates. The 10Y treasury yield rose in May to 4.4% as the U.S. House passed a budget bill that is expected to increase the deficit. Core PCE inflation for April was 2.5% while headline PCE inflation was below expectations at 2.1% mostly on lower food and energy inflation.

- Apple’s AI Woes. Apple announced in June that it is considering using externally-developed AI models like ones offered by Open AI and Anthropic to power a new version of Siri on its devices instead of an internal model in a major reversal of the company’s AI strategy.

- Big Beautiful Bill. The Senate reviewed the Big Beautiful Bill legislation that the House passed a version of in May. The bill extends the 2017 tax cuts and adds new tax exemptions while cutting Medicaid and other social spending and increasing spending for defense and border security.

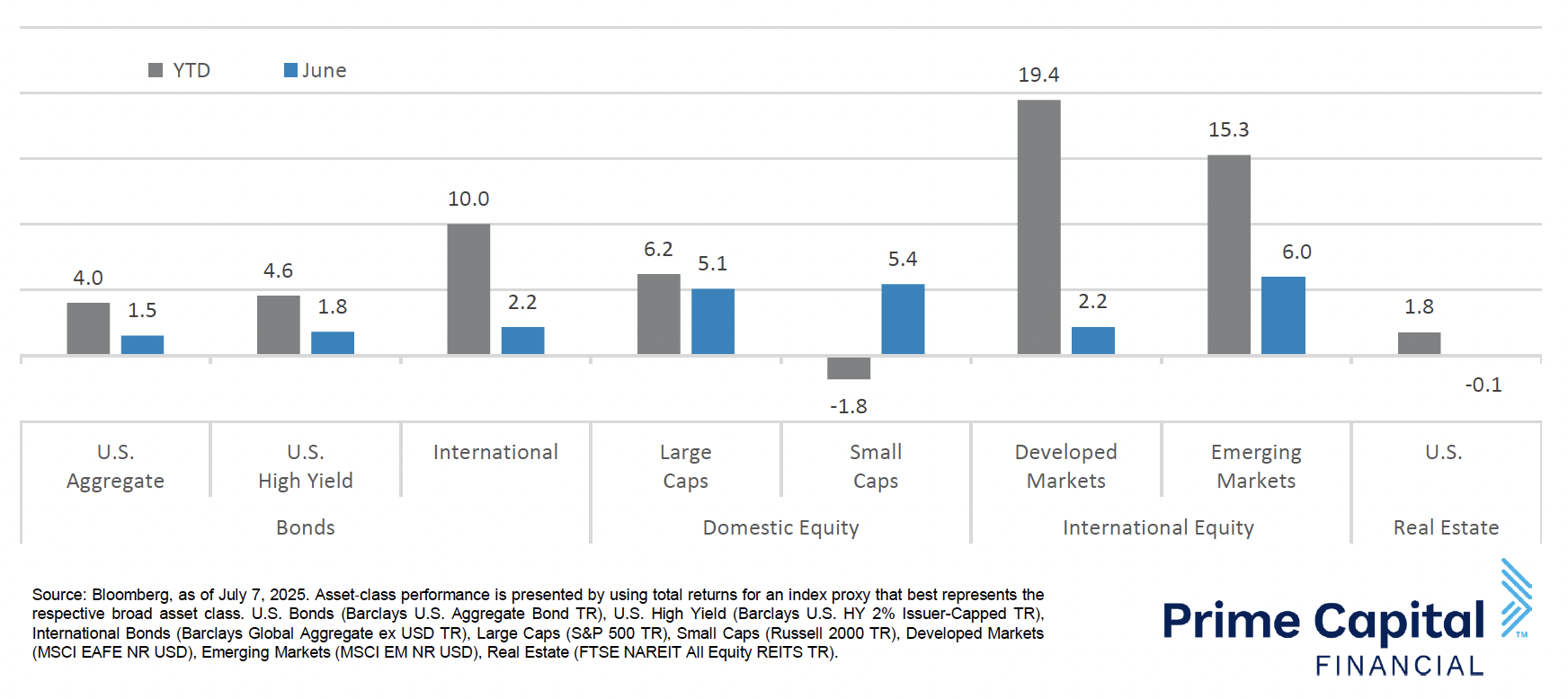

Asset Class Performance

Small caps outperformed large caps in June. U.S. stocks outperformed developed market stocks but underperformed emerging markets as economic data remains mixed and the Fed held interest rates steady. Stocks and bonds were generally higher in June while real estate fell slightly.

Markets & Macroeconomics

U.S. consumers have become increasingly cautious on spending as retail sales declined in May by 0.9% from April levels marking the second consecutive monthly decline and the largest month-over-month decline in over two years. Motor vehicle and parts stores, food and beverage services, and building and garden materials experienced particularly large declines. Core CPI inflation remained flat, although was below expectations, in May coming in at 2.8% while headline CPI inflation came in at 2.4%.

Shelter, medical care services, and education services inflation eased slightly in May while transportation services, transportation commodities, and household furnishings and supplies experienced acceleration in their inflation rates year-over-year, although these changes were slight. Food and energy inflation both accelerated during the month, although energy inflation remained negative. Core PCE inflation came in slightly higher than forecasted at 2.7% and the headline figure came in at 2.3%. In the labor market, the U.S. added 139K jobs in May, mostly in education and health services and leisure and hospitality. Professional and business services experienced a decline of 18K jobs month-over-month as businesses laid off administrative and support staff.

The manufacturing also shed 8K jobs and mining and logging each cut 1K positions in May. April’s job additions figure was revised down from 177K new positions to 147K jobs. Initial jobless claims have also been rising in recent weeks, although they declined in the final week of June, with the 4-week moving average now at 245.0K claims. The labor force participation rate fell slightly in May from 62.6% to 62.4% and the unemployment rate remained unchanged at 4.2%. On June 18th, the Fed announced that it was maintaining its policy rate at 4.25-4.50% with the consensus among FOMC participants being that the policy rates will be cut by 50 bps from current levels by the end of 2025. The Fed also reduced its GDP growth outlook for 2025 to 1.4% and increased its PCE inflation projection to 3% with tariffs driving inflation expectations higher.

Bottom Line: The Fed continued to maintain its policy rate in place at the June meeting and reduced estimates for GDP growth while increasing its inflation forecast. Consumers cut back in May while inflation remained unchanged. Initial jobless claims have increased in recent weeks amid slower job growth.

Download the Full Month in Review Report:

©2025 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Sources for this market commentary derived from Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2025 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.