Quick Takes

- Mixed Markets. October was more eventful for stocks than September due to a flurry of earnings reports from major companies. The S&P 500 rose in the first half of the month amid strong bank earnings but erased all the gains on the final day of October on disappointing earnings forecasts.

- Inflation and Interest Rates. The 10Y treasury yield rose significantly in October from under 3.8% at the beginning of the month to nearly 4.3% by the end of the month. Meanwhile, the Consumer Price Index rose more than expected YoY, increasing 2.4% versus the forecasted 2.3%.

- Tech Selloff. Technology stocks including Microsoft, Meta, and Apple sold off amid concerns about high AI infrastructure and product development costs and disappointing forecasts for Q4. Apple reported weak China results and missed analysts’ expectations on services revenue while Meta indicated more capital expenditure on AI infrastructure ahead.

- Geopolitics. Conflict continued to rage in the Middle East in October as Israel remains at war with Iran, Hamas, and Hezbollah. The conflict escalated during the month after Iran fired missiles into Israel on October 1 and Israel retaliated hitting Iranian military targets later in the month.

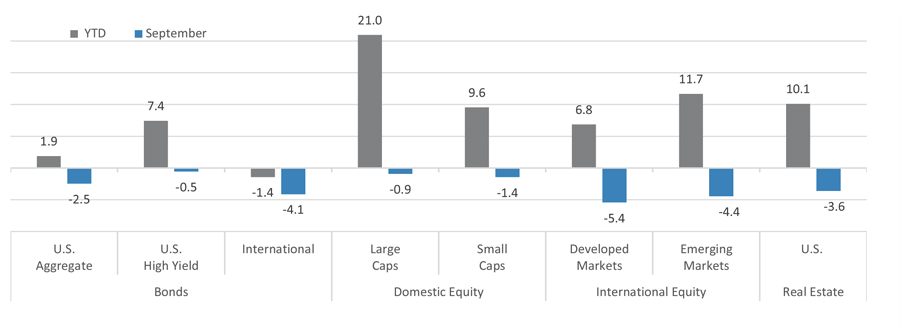

Asset Class Performance

Large Caps had a good October relative to Small Caps, continuing September’s pattern. International equities underperformed the U.S. market during the month amid conflict in the Middle East and geopolitical tensions. Asset classes across the board ended the month lower including both fixed-income and equities.

Markets & Macroeconomics

The economy continued to show signs of strength in October as job growth came in significantly above expectations for September and general economic activity continued to expand. Nonfarm payrolls increased in September by 254k versus the expected increase of 150k. The unemployment rate also fell from 4.2% to 4.1% during the month, indicating that hiring remains strong despite unemployment rising year to-date. Overall economic activity also continued to grow during the month as indicated by the S&P Global Composite PMI which was 54.3 for the month of October.

Anything above a 50 indicates expansion while a reading below 50 indicates contraction. US economic growth has been driven by services growth. Manufacturing, by contrast, continued to see contraction in activity as production was constrained by labor strikes and two hurricanes. Inflation meanwhile remained slightly stickier than expected with inflation readings coming in slightly higher than forecasts. Personal Consumption Expenditures excluding food and energy (Core PCE) was up 2.7% YoY in September versus the expected YoY increase of 2.6%. This also was shown in the CPI numbers as September’s YoY change in the CPI was 2.4% versus the expected 2.3% jump.

Despite the slightly higher reported figures, inflation remains much lower than it was at the beginning of the year. The housing market showed mixed signals this past month as mortgage rates remain high despite a 50bps rate cut by the FOMC in September. The 30-year mortgage rate rose from 6.7% at the beginning of the month to nearly 7.3% by the end of the month. New home sales for September came in above expectations at 738k versus the forecast of 720k, but existing home sales came in at 3.84M versus the expected number of 3.88M for the same month. The next FOMC meeting is on November 7, for which interest rate futures markets have priced in a 25bps cut as the most likely scenario. Companies and investors will also be watching the outcome of the US presidential election on November 5 closely.

Bottom Line: With inflation coming in higher than expected and economic activity remaining strong, the Fed is unlikely to cut rates by 50bps in November. A 25bps cut amid high interest rates and mortgage rates, slower job growth, and a YTD increase in unemployment remains the most likely decision at the FOMC meeting on November 7. The FOMC will also likely take into account the recent weakness in manufacturing and look to lower rates to boost the sector.