Quick Takes

- Mag 7 Lags Stocks. Equity indices rose in January as the S&P 500 index increased 2.7%, the Dow rose 4.7%, and the Russell 2000 was up 2.6%. Despite a strong overall month, the Magnificent 7, which has driven stock gains over the last two years, lagged the broader indices falling 0.3% on the month.

- Inflation and Interest Rates. The 10Y treasury yield rose in the first half of January only to fall back to where it was to start the month at 4.5%. Inflation rose in December as the PCE index rose 2.6% year-over-year. Despite the higher headline number, core inflation remained flat at 2.8%.

- AI Spending Continues. Big technology companies will continue to spend on AI capital investment in 2025. Meta Platforms indicated that it would spend $60-65B on capital investment in 2025. Microsoft indicated that it would invest $80B in 2025 to continue its own data center capacity expansion.

- Trump’s Executive Orders. President Trump signed 45 executive orders by the end of January after taking office on January 20th. The executive orders made policy changes related to tariffs, immigration, energy, regulation, DEI, and the military.

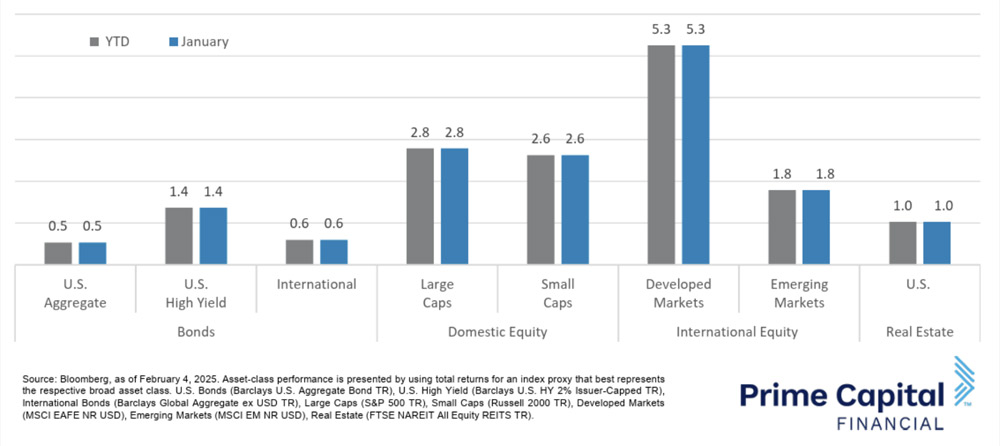

Asset Class Performance

Large caps and small caps were nearly even in January. US stocks outperformed emerging markets, but lagged developed markets as tariff concerns, policy uncertainty, mixed earnings and inflation data drove markets. Domestic and international assets alike ended the month slightly higher including both fixed-income and equities.

Markets & Macroeconomics

Economic data indicated that the economy remained strong in December as job growth accelerated and some inflation measures came in below expectations. In the labor market, the US economy added 256K jobs in December, much better than the forecasted 165K that economists were anticipating. Private payroll growth was particularly strong with companies adding 223K jobs versus the 140K forecast for the month. One sore spot for job growth continued to be the manufacturing sector, which saw a decline in employment of 13K jobs during the month versus the projected addition of 5K jobs. Average hourly wages grew at a historically strong rate, but slightly below forecasted at 3.9% in December versus expectations of 4% growth. The labor force participation rate (LFPR) remained steady at 62.5% and the unemployment rate fell from 4.2% to 4.1%. In terms of inflation, all the major price indices changed as expected or increased less than forecasted. The Producer Price Index (PPI) came in 3.3% higher in December versus a year prior, below expectations of a 3.5% increase. Core PPI also came in below expectations at 3.5% versus the 3.8% forecast.

CPI and PCE inflation showed similar easing as CPI inflation came in at 2.9% in December and PCE inflation came in at 2.6%, both in line with expectations. Core CPI and Core PCE showed even more inflation progress with Core CPI inflation coming in at 3.2% versus expectations of 3.3% and Core PCE inflation came in at 2.8%, in-line with expectations. Retail sales, meanwhile, lagged expectations in December, rising just 0.4% during the month versus the forecasted 0.6%, but grew faster than expected when excluding auto and gas sales.

GDP growth in Q4 2024 was weaker than forecasted as well with the economy growing at an annualized rate of 2.3% versus the expected 2.6%. Fed Chairman Jerome Powell indicated that risks to inflation and unemployment are roughly in balance and that the Fed would not change its 2% inflation target when it reviewed policy in the summer. The FOMC held rates constant in January at 4.25-4.5%. Uncertainty around tariffs and other policy changes under the new administration has clouded the Fed’s outlook for the economy and rates and Powell and other Fed officials will need to consider these policy changes and their impacts before adjusting rates further.

Bottom Line: Inflation remaining elevated and policy uncertainty around immigration and tariffs continue to be barriers to interest rate cuts by the Fed. Meanwhile, the economy continues to see strong job growth, but retail sales and GDP growth were behind expectations to close out 2024. Manufacturing job growth continues to be weak and lag expectations despite strong growth elsewhere.